Join The 9x IPO Club

Over 50 Growth-Stage Companies Successfully Listed on Nasdaq — You Could Be Next

Prepare for a Successful IPO and Navigate the Nasdaq Journey with Confidence

Nasdaq-Focused

Framework

50+ Founders

Guided

Structured by Licensed Capital Advisors

Nasdaq-Focused Framework

50+ Founders Guided

Structured by Licensed Capital Advisors

50+

IPO journeys guided globally

XX+

Founders Helped

XX+

Years of Experience

Listed Companies We've Helped

Introducing The 9x IPO Club

Everything You Need to Go from Pre-IPO to Ringing the Bell — Backed by Expert Advisors, Capital Access, and Elite Founder Networks.

IPO Readiness GAP Report

Submit your financials and deck — get a full audit from our advisory firm, MPVI Capital.

Worth $8,000

1-on-1 Diagnostic Call

Go through your results with an IPO expert — clarify your next steps.

Worth $1,000

Access to Pre-IPO Capital Partners

Tap into our trusted fund network (Asia, MENA, U.S.) for early-stage or pre-IPO capital.

Worth $2,000

Private Networking Meetups

Monthly in-person sessions (Singapore/HK) and quarterly luxury events (e.g., yacht meetups).

Worth $3,000

Mentorship Access (4x/yr)

Get four 1-on-1 strategy sessions with senior business or IPO mentors.

Worth $2,000

Live Pitch Events

Be invited to attend or pitch in real fund-raising and IPO-stage demo sessions.

Worth $1,500

Invited Masterclasses & Training

Quarterly founder education on valuation, board structure, U.S. entity setup, etc.

Worth $1,500

Nasdaq Bell Access

Be invited to witness IPOs from within the club — live from Times Square.

Priceless

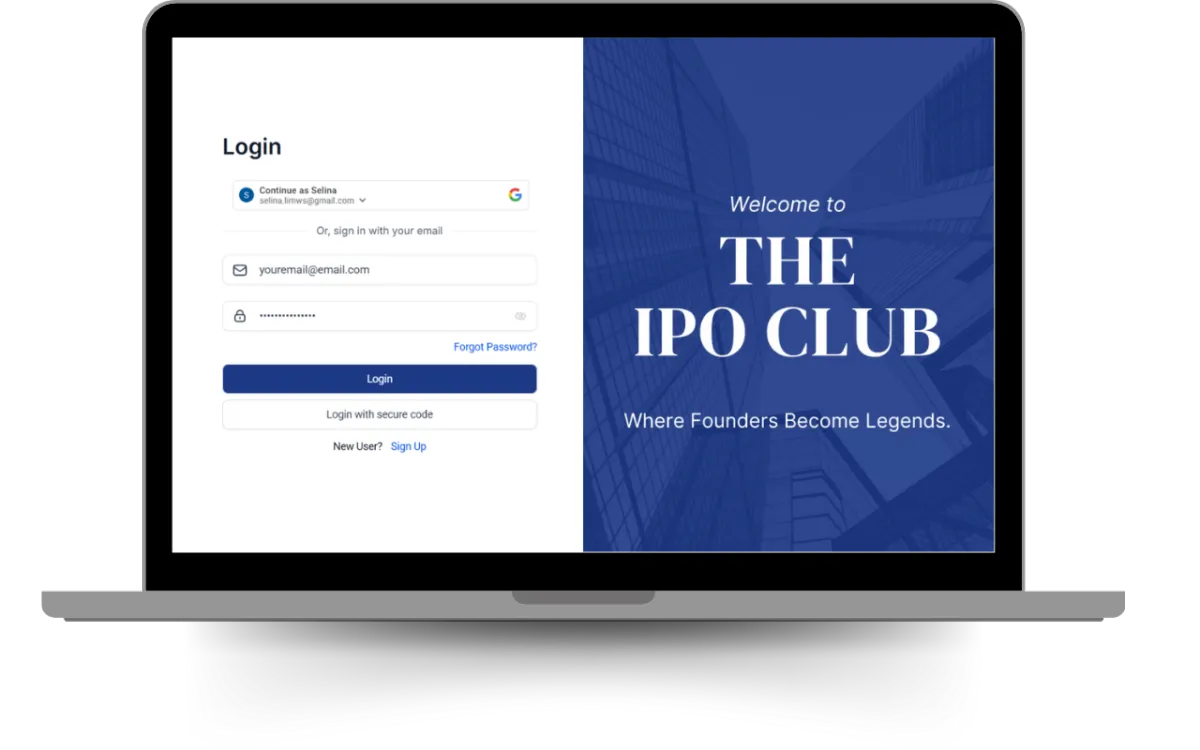

Members Portal Access

Recordings, templates, and tools to support your growth.

Worth $997

Total Estimated Value

$19,997+

You pay: $9,997

12-month journey designed to change your future

Does This Sound Like You?

Uncertainty Around Capital Planning & Exit Timing

You’re constantly wondering: Should we raise more? Exit soon? Go public? When is the right time?

This lack of clarity leads to decision paralysis and more often that not, unnecessary procrastination of potential growth and revenue.

Overload from Scaling While Managing Investor Expectations

Juggling rapid growth, team expansion, and investor pressure creates immense stress for you.

Your board wants clarity on outcomes and IRR, but there's no roadmap.

No Clear Playbook for Going Public

The term 'IPO' gets thrown around, and you don't know what that entails or how to begin.

There’s no visibility into costs, requirements, or timing, and you end up missing opportunities.

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

What if...

What if…

You had a clear roadmap showing you exactly when to raise, when to exit, and when to go public — without feeling stuck in constant uncertainty?

You have an IPO readiness report that reveals where you stand today and what steps to take next.

Finally, what if you had a trusted partner to guide you from vision to valuation — preparing you for the public markets with confidence, clarity, and control?

Introducing IPO Club by IIFLE

IPO Readiness GAP Report

Submit your financials and deck — get a full audit from our advisory firm, MPVI Capital.

$8,000

1-on-1 Diagnostic Call

Go through your results with an IPO expert — clarify your next steps.

$1,000

Access to Pre-IPO Capital Partners

Tap into our trusted fund network (Asia, MENA, U.S.) for early-stage or pre-IPO capital.

$2,000

Private Networking Meetups

Monthly in-person sessions (Singapore/HK) and quarterly luxury events (e.g., yacht meetups).

$3,000

Mentorship Access (4x/yr)

Get four 1-on-1 strategy sessions with senior business or IPO mentors.

$2,000

Live Pitch Events

Be invited to attend or pitch in real fund-raising and IPO-stage demo sessions.

$1,500

Invited Masterclasses & Training

Quarterly founder education on valuation, board structure, U.S. entity setup, etc.

$1,500

Nasdaq Bell Access

Be invited to witness IPOs from within the club — live from Times Square.

Priceless

Members Portal Access

Recordings, templates, and tools to support your growth.

$997

Total Estimated Value

$19,997+

You pay: $9,997

12-month journey designed to change your future

Real People, Real Results

Real results from founders who transformed their businesses through our program

Jason

CEO

“IIFLE gave me a clear blueprint to restructure my company into an investor-ready vehicle. In just a few weeks, I went from pitching with guesswork to presenting with confidence. We’ve since raised capital and are now preparing for our U.S. expansion.”

Kim Tan Mei Wen

HealthTech CEO

“The mentorship at IIFLE was unlike anything I’ve experienced. Anthony and the team didn’t just teach—they walked beside us as we cleaned up our financials, fixed our equity cap table, and built our pre-IPO roadmap.”

Daniel C.

Saas Founder

“Before IIFLE, we didn’t know what investors were really looking for. After going through The Join The 9x IPO Club Now, we not only understood it—we secured commitments from two institutional partners introduced by their network.”

CHECKOUT FORM

Complete your order

still unsure?

Frequently Asked Questions

Are we too early to think about IPO?

If you’re Series B or later, you’re not too early. In fact, starting 12–24 months ahead puts you in the best

position for valuation and timing.

Do we need to be based in the U.S. to list on Nasdaq?

No. We help international companies structure U.S. holding entities and listing vehicles without moving

your operations.

How long does a Nasdaq IPO typically take?

12–18 months is standard. We’ll build you a personalized timeline based on your audit, legal, and internal

readiness.

How much does it cost to go public?

The full IPO journey costs around USD 1.37M (excluding success fees), phased across milestones. We’ll

walk you through each one.

What if we’re not ready yet?

That’s exactly why we start with an IPO readiness report. We’ll identify what’s missing and help you build toward IPO readiness.

Do we need a CFO or in-house legal team to start?

No. We’ve helped first-time founders, lean teams, and even solo CEOs through the process with external

partners.

What documents do we need to provide?

Basic materials like financials, cap table, and management structure. You’ll get a full checklist on the first

call.

Will we lose control of the company after IPO?

Not if it’s structured properly. We advise on dual-class shares and governance to protect founder control

post-listing.

What happens after we go public?

We offer post-IPO IR support, earnings coaching, and investor communications — we don’t leave you at the bell.

© 2025 - All Rights Reserved.

The 9x IPO Club | By N Capital Networks Pte Ltd

Terms and Conditions | Privacy Policy | Disclaimer

This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.