YOUR EXCLUSIVE INVITATION TO BETTER GROWTH AND REVENUE AWAITS!

How To Build an IPO-Ready Business — Even If You're Not Ready to List

How Founders and Entrepreneurs Can Prepare for a Successful IPO and Navigate the Nasdaq Journey with Confidence

This is an exclusive webinar. Only qualified individuals will be granted access. Submit your details, and if you meet the criteria, we’ll send you the Zoom information

50+

IPO journeys guided globally

XX+

Founders Helped

XX+

Years of Experience

Listed Companies We've Helped

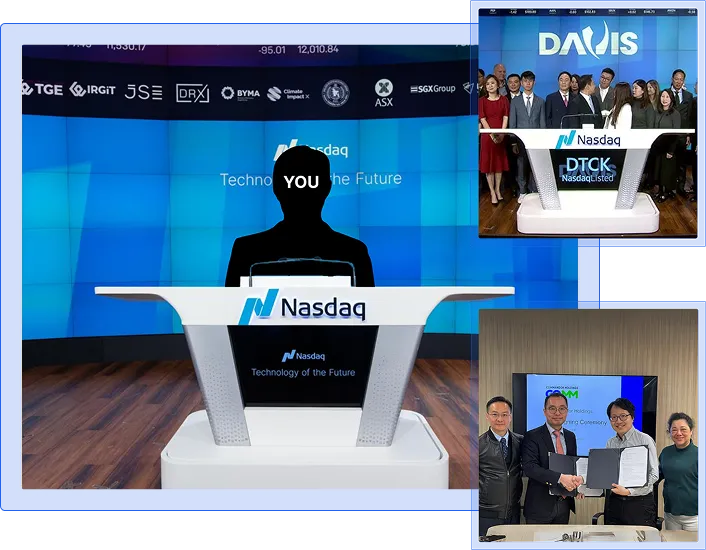

Imagine ringing the Nasdaq bell

— not as a fantasy, but as a strategy

Going public is one of the most powerful moves a company can make, and it’s a dream many founders share — to gain validation, status, and a lasting legacy in the business world.

They aim to demonstrate to investors that their company is truly successful while creating generational wealth, without compromising their vision and leadership.

Most people see the Nasdaq bell as a distant dream — a symbol of success reserved for billion-dollar companies and tech giants.

This can be your reality too.

With the right roadmap and support, you can take your company public on your own terms and build a legacy that stands the test of time

That moment — standing on a stage, being recognized for what you’ve built — it’s not just for the unicorn startups or corporate giants.

It’s for business owners like you: The ones putting in the work, building offers that change lives, and showing up day after day with purpose.

You don’t need to wait years to feel that momentum.

You can start building the systems, strategy, and visibility that move you from overlooked… to undeniable.

Thousands have done it — not because they had more talent or resources — but because they aligned their vision with the right strategy and support.

If you're leading a fast-growing company and considering an IPO...

...you're likely facing big questions:

Uncertainty Around Capital Planning & Exit Timing

You’re constantly wondering: Should we raise more? Exit soon? Go public? When is the right time?

This lack of clarity leads to decision paralysis and more often that not, unnecessary procrastination of potential growth and revenue.

Overload from Scaling While Managing Investor Expectations

Juggling rapid growth, team expansion, and investor pressure creates immense stress for you.

Your board wants clarity on outcomes and IRR, but there's no roadmap.

No Clear Playbook for Going Public

The term 'IPO' gets thrown around, and you don't know what that entails or how to begin.

There’s no visibility into costs, requirements, or timing, and you end up missing opportunities.

Did You Know You Could IPO Sooner Than You Think — If You Stop Waiting for ‘Perfection’?

What if…

You had a clear roadmap showing you exactly when to raise, when to exit, and when to go public — without feeling stuck in constant uncertainty?

You have an IPO readiness report that reveals where you stand today and what steps to take next.

Finally, what if you had a trusted partner to guide you from vision to valuation — preparing you for the public markets with confidence, clarity, and control?

This masterclass is here to help you get clear on the whole IPO journey — guiding you through readiness, picking the right exchange, navigating regulations, and building a strong post-IPO strategy.

this is for you if you're...

You’re a growth-stage tech founder or C-suite leader (CEO, CFO) in SaaS, Fintech, HealthTech, AI, or CleanTech, with $5M+ in revenue or strong growth beyond Series B, ready to explore IPO as your next expansion move.

You lead a global startup from Asia, LatAm, EU, or MENA, aiming to attract U.S. capital, boost visibility, and support VCs or institutional investors seeking liquidity within the next 12–24 months.

You’re a first-time IPO explorer who wants clear, step-by-step guidance on timeline, cost, governance, and structure, and you're under pressure from your board or investors to make informed strategic decisions.

Learn From The Expert Who’s Been There

Meet Mr. David Teh

A seasoned capital advisor and strategic partner, Mr. David Teh brings years of hands-on experience helping businesses grow, scale, and go public. He is passionate about guiding companies through complex financial landscapes with clarity and confidence.

Co-Founder and Managing Partner of MVP International Capital, specializing in the ASEAN region

Raised funds and provided capital advisory to over 30 companies preparing for IPOs and Nasdaq listings

Trusted expert in family trust and fund management for high-net-worth individuals and listed companies

Managed cross-border investment portfolios and strategic market entry across Finance, Tech, F&B, and more

Recognized for delivering tailored financial solutions for entrepreneurs and enterprises in Malaysia and Singapore

Go From Vision to Reality

Before The Webinar

You’re overwhelmed by the complexity of going public — unsure where to start or how to meet Nasdaq’s strict requirements.

Confusion about timelines, legal structures, and costs leaves you stuck, delaying your IPO plans.

You worry about losing control of your company or wasting precious resources on costly missteps.

You lack a clear capital strategy and feel the pressure from investors without a roadmap to guide you.

The dream of ringing the Nasdaq bell feels distant, out of reach, and almost impossible to achieve.

After The Webinar

You have a clear, expert-designed 4-phase roadmap that simplifies every step of your IPO journey.

You understand exactly what’s needed, when, and how much it will cost — no surprises, just milestones.

You retain control and protect your vision with dual-class structures and tailored governance advice.

Investor expectations are managed with confidence as you scale, backed by comprehensive legal, audit, and IR support.

You confidently walk into bell-ringing day, knowing you’ve joined the ranks of elite founders who’ve successfully gone public — creating a lasting legacy and generational wealth.

this is for you if you're...

You’re a growth-stage tech founder or C-suite leader (CEO, CFO) in SaaS, Fintech, HealthTech, AI, or CleanTech, with $5M+ in revenue or strong growth beyond Series B, ready to explore IPO as your next expansion move.

You lead a global startup from Asia, LatAm, EU, or MENA, aiming to attract U.S. capital, boost visibility, and support VCs or institutional investors seeking liquidity within the next 12–24 months.

You’re a first-time IPO explorer who wants clear, step-by-step guidance on timeline, cost, governance, and structure, and you're under pressure from your board or investors to make informed strategic decisions.

Learn From The Expert Who’s Been There

Meet Mr. David Teh

A seasoned capital advisor and strategic partner, Mr. David Teh brings years of hands-on experience helping businesses grow, scale, and go public. He is passionate about guiding companies through complex financial landscapes with clarity and confidence.

Co-Founder and Managing Partner of MVP International Capital, specializing in the ASEAN region

Raised funds and provided capital advisory to over 30 companies preparing for IPOs and Nasdaq listings

Trusted expert in family trust and fund management for high-net-worth individuals and listed companies

Managed cross-border investment portfolios and strategic market entry across Finance, Tech, F&B, and more

Recognized for delivering tailored financial solutions for entrepreneurs and enterprises in Malaysia and Singapore

Go From Vision to Reality

Before The Webinar

You’re overwhelmed by the complexity of going public — unsure where to start or how to meet Nasdaq’s strict requirements.

Confusion about timelines, legal structures, and costs leaves you stuck, delaying your IPO plans.

You worry about losing control of your company or wasting precious resources on costly missteps.

You lack a clear capital strategy and feel the pressure from investors without a roadmap to guide you.

The dream of ringing the Nasdaq bell feels distant, out of reach, and almost impossible to achieve.

After The Webinar

You have a clear, expert-designed 4-phase roadmap that simplifies every step of your IPO journey.

You understand exactly what’s needed, when, and how much it will cost — no surprises, just milestones.

You retain control and protect your vision with dual-class structures and tailored governance advice.

Investor expectations are managed with confidence as you scale, backed by comprehensive legal, audit, and IR support.

You confidently walk into bell-ringing day, knowing you’ve joined the ranks of elite founders who’ve successfully gone public — creating a lasting legacy and generational wealth.

Get Ready To Walk Away With…

A clear understanding of what an IPO (Initial Public Offering) really is and how it works

Insight into the key benefits of going public, including capital growth, brand credibility, and liquidity

Practical knowledge on how an IPO can transform your business growth and market positioning

Awareness of the different stages of the IPO process and what to expect at each phase

Understanding of the regulatory and compliance essentials specific to Nasdaq listings

Real-world examples of companies that successfully transitioned to IPO and lessons learned

A clear understanding of what an IPO (Initial Public Offering) really is and how it works

Insight into the key benefits of going public, including capital growth, brand credibility, and liquidity

Practical knowledge on how an IPO can transform your business growth and market positioning

Awareness of the different stages of the IPO process and what to expect at each phase

Understanding of the regulatory and compliance essentials specific to Nasdaq listings

Real-world examples of companies that successfully transitioned to IPO and lessons learned

still got questions?

Frequently Asked Questions

Are we too early to think about IPO?

If you’re Series B or later, you’re not too early. In fact, starting 12–24 months ahead puts you in the best

position for valuation and timing.

Do we need to be based in the U.S. to list on Nasdaq?

No. We help international companies structure U.S. holding entities and listing vehicles without moving

your operations.

How long does a Nasdaq IPO typically take?

12–18 months is standard. We’ll build you a personalized timeline based on your audit, legal, and internal

readiness.

How much does it cost to go public?

The full IPO journey costs around USD 1.37M (excluding success fees), phased across milestones. We’ll

walk you through each one.

What if we’re not ready yet?

That’s exactly why we start with an IPO readiness report. We’ll identify what’s missing and help you build toward IPO readiness.

Do we need a CFO or in-house legal team to start?

No. We’ve helped first-time founders, lean teams, and even solo CEOs through the process with external

partners.

What documents do we need to provide?

Basic materials like financials, cap table, and management structure. You’ll get a full checklist on the first

call.

Will we lose control of the company after IPO?

Not if it’s structured properly. We advise on dual-class shares and governance to protect founder control

post-listing.

What happens after we go public?

We offer post-IPO IR support, earnings coaching, and investor communications — we don’t leave you at the bell.

© 2025 - All Rights Reserved.

The 9x IPO Club | By N Capital Networks Pte Ltd

Terms and Conditions | Privacy Policy | Disclaimer

This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.